MediMedia International: A Leveraged Buyout Analysis

Assessing the Financial Viability, Risk, and Value Creation Potential of a 1990s Management Buyout

1. Executive Summary

Our valuation analysis, incorporating Adjusted Present Value (APV), peer multiples, and an LBO model, estimated MediMedia’s Enterprise Value at $131.32 million and equity value at $72.19 million, supporting the buyout decision. The deal presented strong investor returns, with IRRs exceeding expectations under reasonable exit multiples.

However, the success of the buyout was contingent on effective debt management and sustained EBITDA growth. While the structured financing strategy optimized capital costs, the company’s high leverage required disciplined financial oversight to mitigate risks and ensure long-term viability.

$131.32M

Enterprise Value

$72.19M

Equity Value

71%

IRR (Year 5)

$60.17M

Debt Financing

5.9x

EBITDA Exit Multiple

2. Introduction

By 1990, MediMedia International had established itself as a leading provider of medical publishing and pharmaceutical marketing solutions, operating as a subsidiary of Dun & Bradstreet (D&B). However, under D&B’s ownership, corporate bureaucracy stifled decision-making, limiting MediMedia’s ability to pursue strategic growth opportunities and adapt to market dynamics.

Recognizing the need for greater autonomy, the company’s management team orchestrated a leveraged buyout (LBO) to regain control and reposition the business for long-term success. The acquisition was financed through a mix of senior debt, mezzanine financing, and equity contributions from management, with the equity portion oversubscribed by $2 million—a strong indicator of management’s confidence in the deal.

This analysis evaluates whether the MediMedia buyout was financially viable, focusing on valuation, debt structuring, and investor returns, while assessing the risks and opportunities associated with highly leveraged transactions.

Key questions explored

-

Was the purchase price justified based on valuation models?

-

Could the high debt burden be sustained?

-

What were the potential risks and investor returns?

Skills demonstrated

Excel

PowerPoint

Financial modeling

Strategic decision-making

Debt structuring

Teamwork

3. Cash Flow & Debt Analysis: Can MediMedia Sustain Leverage?

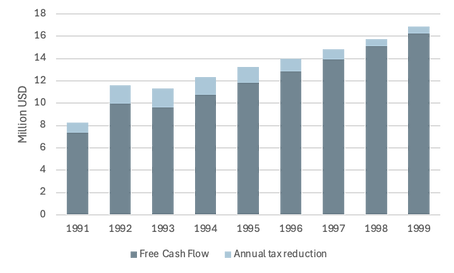

Free Cash Flow and Tax Shield Contributions

A steady and predictable increase in free cash flow (FCF) played a critical role in ensuring MediMedia’s ability to service its debt obligations post-buyout. As the company expanded operations and optimized efficiency, cash flow generation improved year over year, reinforcing the feasibility of the highly leveraged capital structure.

One of the key financial benefits of the LBO was the impact of tax shields. By utilizing interest deductions on debt, MediMedia reduced its taxable income, increasing cash flow available for debt repayment and equity returns. Leveraging tax advantages enhanced enterprise value, making debt financing a strategically beneficial tool rather than just a burden.

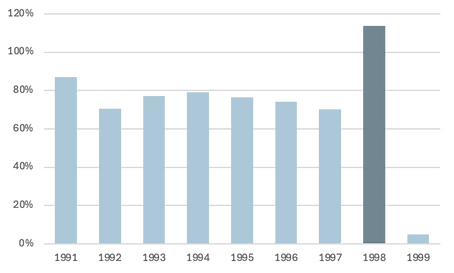

Interest payments as % of FCF

The interest burden remained relatively stable as a percentage of free cash flow (FCF) throughout the forecast period, reflecting the company’s ability to manage its debt obligations effectively. However, in 1998, a temporary spike in interest payments occurred due to a combination of increased debt servicing and timing mismatches in cash flows, emphasizing the sensitivity of a leveraged structure to shifts in financial conditions.

This highlights the inherent risks of high leverage, where even short-term fluctuations in cash flow or debt costs can impact financial stability. Nevertheless, MediMedia’s steady FCF growth helped to quickly normalize the interest burden by 1999, ensuring a return to manageable levels.

4. Valuation Analysis: How Much Was MediMedia Worth?

To determine a fair price, we used three valuation approaches:

Adjusted Present Value (APV) Valuation

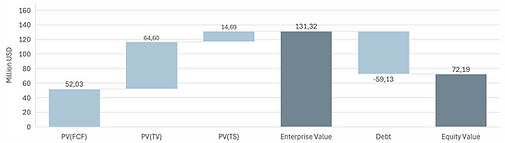

APV Method and EV to Equity Bridge

The Adjusted Present Value (APV) analysis confirms that MediMedia’s enterprise value of $131.32M is well-supported by fundamental valuation, with tax shields contributing significantly to value creation. The EV to Equity Bridge highlights how debt financing, while a burden, enhances equity value through tax benefits, making the LBO structure financially viable.

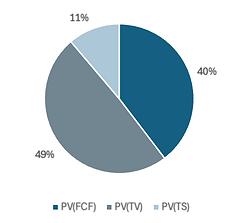

The Enterprise Value Composition breakdown highlights that 49% of the company’s value is derived from its terminal value, emphasizing the importance of long-term strategic growth and EBITDA sustainability post-buyout. The composition also underscores the dependency on operational efficiency and market stability, as any deviation from projected performance could significantly impact valuation outcomes.

Enterprise Value Composition

Peer Group Valuation (Market Approach)

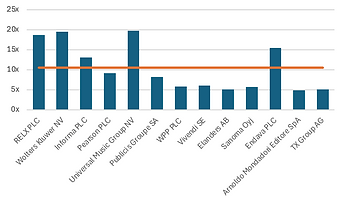

Peer Group EV/EBITDA Multiples

A peer group EV/EBITDA multiple comparison further validates the valuation, positioning MediMedia within a competitive range relative to industry benchmarks.

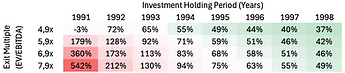

Sensitivity Analysis

The sensitivity analysis on exit multiples and time horizon illustrates the direct impact of valuation assumptions on investor returns, with the 5.9x exit multiple emerging as the most balanced scenario, offering a 71% IRR in Year 5. .

5. Debt Structuring & Risk Management

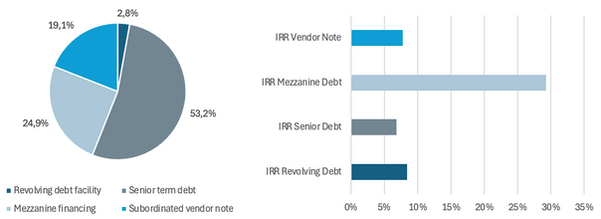

The debt structure reflects a strategic use of senior and mezzanine debt to optimize financing costs. The weighted average cost of debt (WACD) was calculated at 8.03%, demonstrating favorable borrowing terms relative to the market.

The high IRR for mezzanine financing reflects the higher risk-reward profile of this debt type, driven by the inclusion of warrants. The revolving credit facility's IRR is competitive, but its flexibility increases costs compared to senior debt.

Debt Structure

IRR Comparison Across Debt Instruments

6. Conclusion: Was the LBO a Smart Move?

Yes. The MediMedia LBO was a financially justified transaction, delivering high investor returns with manageable debt risk, provided EBITDA growth was sustained. With a 71% IRR at a 5.9x exit multiple, and strong cash flow stability the deal was financially sound. However, high leverage required strict risk management, as EBITDA fluctuations or interest rate shifts could impact debt service.