Netscape’s IPO: Pricing Dilemma and Valuation Analysis

Assessing the Initial Public Offering Strategy, Valuation, and Market Conditions of Netscape in 1995

1. Executive Summary

Netscape’s Initial Public Offering (IPO) marked one of the most significant moments in tech finance history. Originally priced at $14 per share, strong investor demand led to an increase to $28, raising questions about whether the company was undervalued or riding a market bubble.

Our DCF valuation estimated Netscape’s fair value at $31.75 per share, indicating an 11% underpricing at the final IPO price. Key value drivers included strong revenue growth, fueled by the expanding internet user base, and cost efficiencies expected in Netscape’s scaling phase. The case highlights the challenges of pricing high-growth tech IPOs, balancing investor demand with fundamental valuation.

IPO Pricing Evaluation

$1,207M

Equity Value

11.35%

WACC

28.3%

IRR

48%

Annual Growth Rate

2. Introduction

On August 8, 1995, Netscape’s board of directors faced a major pricing dilemma: should they stick with the $14 IPO price or double it to $28 based on overwhelming investor demand? The decision reflected broader uncertainties about how to value early-stage internet companies in an emerging tech industry.

Founded in 1994, Netscape pioneered web browsing software, achieving a dominant market share with its Netscape Navigator product. Despite rapid growth, the company had yet to generate profits, raising concerns about whether high valuations were justified.

Key questions explored

Skills demonstrated

-

Was Netscape’s IPO fairly priced or undervalued?

-

Could high revenue growth justify the aggressive valuation?

-

What were the risks and alternatives to an IPO?

Excel

PowerPoint

Strategic decision-making

Financial forecasting

Teamwork

3. Revenue Growth and Market Potential

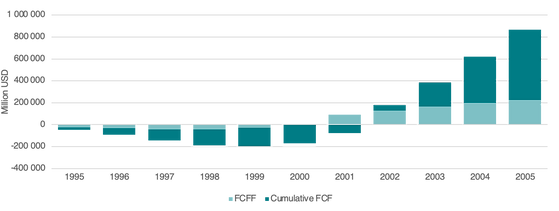

Free Cash Flow Analysis and Cumulative Growth (1995–2005)

1.45

Current Ratio

-0.28

Operating Margin

0.41

Asset Turnover

-0.38

ROA

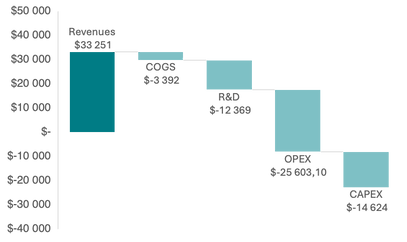

Revenue and Cost Breakdown 1995

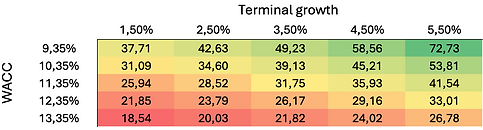

The DCF model incorporated a sensitivity analysis, showing how variations in terminal growth rates and discount rates (WACC) affected valuation. With a base-case WACC of 11.56% and a terminal growth of 3.5%, the intrinsic value per share reached $31.75, validating the decision to raise the IPO price above $14.

Netscape’s valuation hinged on its projected revenue growth, which was modeled at 48% annually from 1995-2005.

-

$33.25M in revenue

-

COGS of $3.39M

-

Significant R&D expenses of $12.37M to maintain product innovation

-

Operating expenses (OPEX) at $25.60M, reinforcing high initial costs

-

CAPEX investment of $14.62M to establish long-term infrastructure

Despite strong revenue generation, Netscape’s negative operating margin of -28% highlights the high burn rate required to sustain its market leadership.

4. IPO Pricing and Market Sentiment

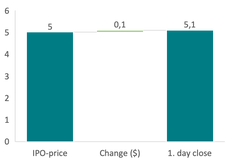

The decision to increase the IPO price from $14 to $28 per share was based on overwhelming demand from institutional investors, high internet sector momentum, and limited supply of high-growth tech stocks.

However, our valuation model priced Netscape at $31.75 per share, suggesting that even at $28, the stock remained undervalued. The underwriters’ cautious approach to pricing helped ensure a successful debut, but it also left money on the table.

Comparables Analysis: Similar IPOs

Alpha Technology Group

Global Mofy Metaverse

Linkage Global

Klaviyo

10% increase

2% increase

28% decrease

9% increase

This analysis confirmed that moderate underpricing aligned Netscape with successful high-growth tech IPOs, ensuring strong demand without overvaluation risks.

6. Conclusion: Was Netscape's IPO Underpriced?

Yes. Netscape’s IPO price of $28 per share was likely too low, given our $31.75 fair value estimate. Had Netscape priced higher, it could have raised additional capital but risked greater post-IPO price swings.