Printicomm's Acquisition of Digitech: Structuring an Earnout for Value Creation

Analyzing the Financial Viability, Risk, and Strategic Deal Structuring for a High-Stakes Acquisition

1. Executive Summary

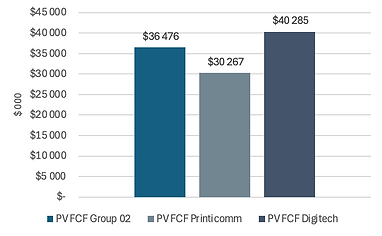

Facing a significant valuation gap, Printicomm sought to acquire Digitech, but differences in growth expectations led to price disagreements. Printicomm valued Digitech at $30.27M, while Digitech's management held firm at $40.29M, citing higher expected sales growth and market positioning. To bridge this gap, an earnout structure was introduced, tying additional payments to future performance.

Our analysis, utilizing DCF modeling, Monte Carlo simulations, and industry multiples, confirms that the structured earnout was an effective solution, balancing risk-sharing and incentive alignment. The preferred Structure 1 ensured lower upfront costs, better management retention, and a $22.93M earnout valuation, making it the financially optimal choice for Printicomm.

2. Introduction

In December 1998, Printicomm, a leading communications and printing solutions firm, identified Digitech as a strategic acquisition target to enhance its digital marketing capabilities. While the synergies were clear, bridging the valuation gap became a challenge, as Digitech’s owner, Frank Greene, insisted on a higher valuation due to growth potential.

Given the importance of retaining key personnel post-acquisition, Printicomm structured a performance-based earnout agreement instead of an all-cash deal. This analysis evaluates the financial viability of the transaction, the valuation methods applied, and the impact of the earnout structure on risk and incentives.

Key questions explored

-

Was the purchase price justified based on valuation models?

-

Could the high earnout payments be sustained?

-

What were the potential risks and investor returns?

Skills demonstrated

Excel

PowerPoint

Financial forecasting

Strategic decision-making

Monte Carlo Simulation

Scenario Analysis

Teamwork

3. Free Cash Flow Insights: Can Printicomm Sustain the Earnout?

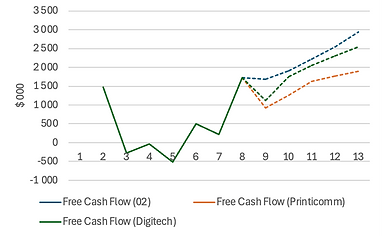

FCF Comparison Across Scenarios

The projected Free Cash Flow (FCF) analysis, using Monte Carlo simulations, highlights diverging expectations between Printicomm and Digitech. Digitech's projections assume higher revenue growth and operating margins, reflecting its confidence in market expansion and customer acquisition strategies. Printicomm, on the other hand, maintains a more conservative forecast, emphasizing potential market fluctuations and operational risks. The variance in projections directly influenced the valuation gap, necessitating an earnout to align expectations.

Present Value of FCF Across Scenarios

This comparison underscores how assumptions about market conditions, revenue growth, and risk appetite impact valuation. Digitech’s aggressive projections led to a higher PV of FCF, while Printicomm’s cautious stance resulted in a lower valuation. A third scenario, Group O2, provides a midpoint projection, balancing growth potential with financial prudence. This highlights the importance of scenario testing in deal structuring.

4. Deal Structuring & Risk Management

Given the valuation mismatch, Printicomm proposed two earnout structures:

Earnout Structure 1

$20.00M

Upfront payment

5 years

Retention period

$22.93M

Total earnout value

This structure was designed to minimize upfront risk while ensuring long-term alignment with Digitech’s management. Under this setup, Printicomm committed to a lower initial payment of $20M, with additional payments contingent on Digitech meeting performance targets over five years. This model ensured that Digitech’s management remained engaged, as their compensation was directly linked to business performance. Additionally, a 25% earnings cap on bonuses mitigated excessive payouts while preserving financial stability.

Total Earnout Payout Structure 1

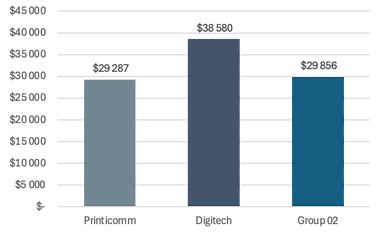

Earnout Structure 2

$28.00M

Upfront payment

3 years

Retention period

$29.86M

Total earnout value

The second structure involved a higher initial payment of $28M but a shorter three-year earnout period. This approach reduced long-term uncertainty but increased Printicomm’s financial exposure, as more capital was committed upfront without full certainty on future earnings. While Digitech still projected a higher payout, the shorter timeframe created less variability between scenarios, making this structure more predictable but also riskier in terms of capital efficiency.

Total Earnout Payout Structure 2

Key risk mitigation strategies

To minimize financial and operational risks, Printicomm implemented several protective mechanisms in the deal structure.

1. An equity rollover component was introduced, ensuring that Digitech’s management maintained a financial stake in the company’s success. This helped align incentives and foster long-term commitment.

2. Performance-based bonuses were structured to incentivize short-term performance without jeopardizing long-term stability.

3. Macro-adjustment clauses were incorporated, allowing Printicomm to adjust earnout payments in response to unforeseen economic shifts, thereby reducing risk exposure in volatile market conditions.

Preferred Option: Earnout Structure 1 provided the best balance between cost efficiency, retention, and financial predictability.

5. Conclusion: Was the Earnout a Smart Move?

Yes. The structured earnout successfully bridged the valuation gap, aligning incentives while limiting Printicomm’s upfront risk. The deal allowed flexibility in payments, ensuring long-term management retention and financial sustainability. However, success depended on maintaining projected sales growth and managing integration risks effectively.